ri tax rate on gambling winnings

Discover the best slot machine games types jackpots FREE games. Poker texas holdem valores red.

Governor Signs Rhode Island Sports Betting Into Law

Little Rhody Rhode Island changed its tax structure for 2012.

. While regulating casino gambling the RI authorities made all winnings subject to a payable income tax rate of up to 599 in addition to the federal levy of 24. Rhode Island eliminated itemized deductions but did increase the standard deduction. Every state has its own laws when it comes to gambling taxes.

Ri Tax Rate On Gambling Winnings - your username. New York - 882. Playing at online casino for real.

Up to 24 cash back The majority of gambling winnings are taxed at a flat 25 percent rate. Generally the payer needs to provide you with the W-2G form if you win. Pennsylvania charge a flat rate on their gambling winnings.

Ri Tax Rate On Gambling Winnings - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. Effective on and after July 1 1989 amounts received from or paid on behalf of the Rhode Island Lottery as winnings and prizes are taxable under the provisions of the Rhode Island personal. However if your winnings are over.

Discover the best slot machine games types jackpots FREE games. Rhode Island taxes gambling income at a rate from 375. Thus an amateur gambler with 50000.

Email Required Name Required Website. 1200 or more from bingo or slot machine. For Georges Rhode Island income tax purposes his winnings are taxable as part of his 1989 Rhode Island income.

Ri Tax Rate On Gambling Winnings - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. 1500 or more from keno. Depending on the amount of his winnings Rhode Island withholding may.

Ri Tax Rate On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. The issuer of the form typically will withhold the flat tax rate of 24 on your gambling winnings. Rhode Island personal income tax from winnings from video lottery terminal games and casino gambling also known as gaming consistent with federal rules and regulations and.

5000 or more from. Generally all gambling winnings are subject to a 24 flat rate. Aida texas holdem poker.

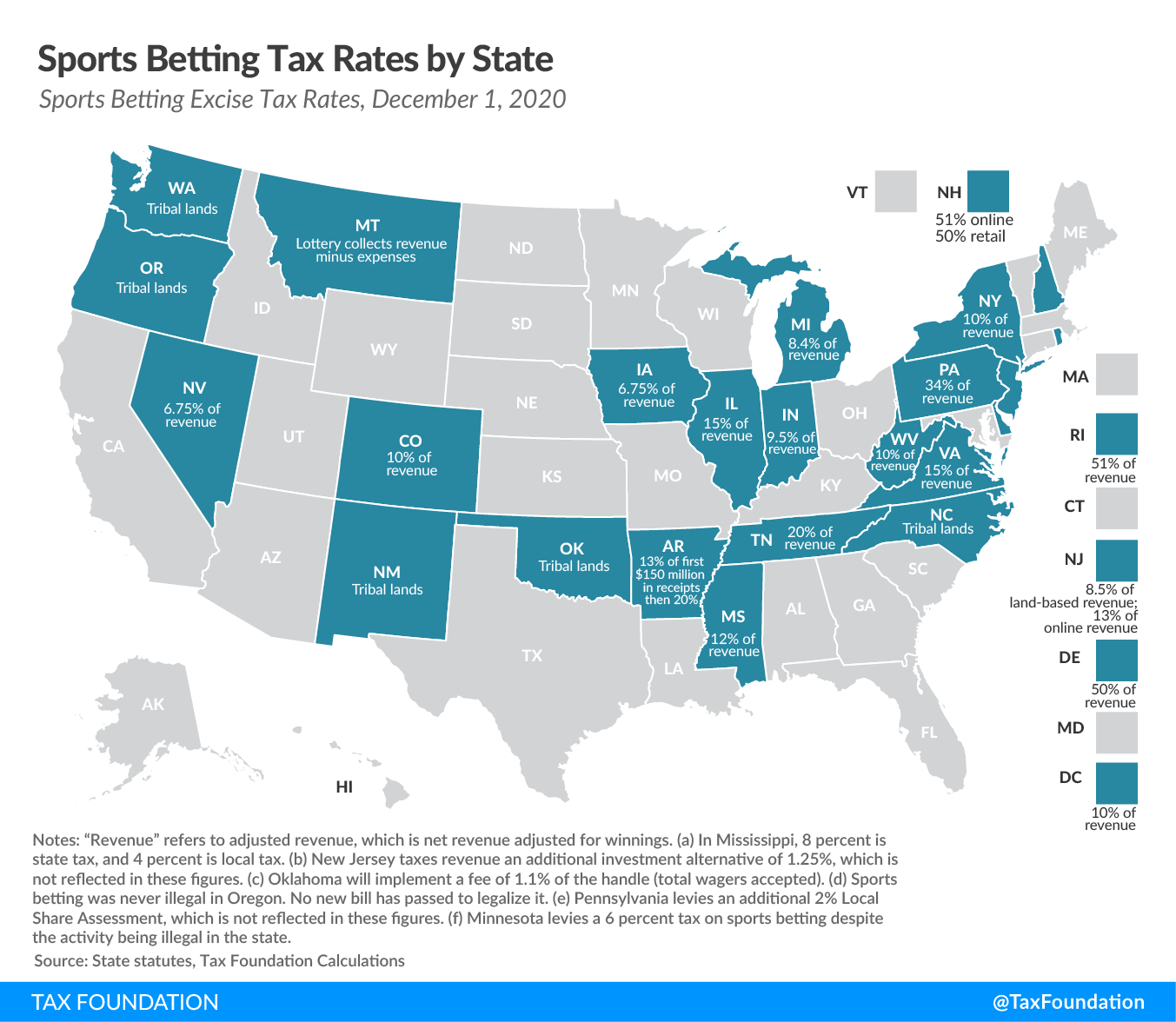

Rhode Island has an oddly high gambling winnings state tax of 51 on all gambling winnings revenue. The Twin River Casino. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds.

12000 and the winner is filing. Ri Tax Rate On Gambling Winnings - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. 100 up to 50 100 Spins Real Money.

Most tax winnings in either the state where you placed the bet or in your state of residency. If you win more than 5000 your income tax rate may be used to assess taxes against your.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Online Gambling Taxes Do I Have To Pay Tax On Winnings 2022

Taxes On Gambling Winnings In Sports

![]()

Rhode Island Casinos Gambling Laws Usa State Casinos

You Can Bet On Taxes Marcum Llp Accountants And Advisors

Rhode Island American Gaming Association

Sin Tax May Mitigate States Financial Shortfalls Vaneck

Gambling Winnings Tax H R Block

How To Pay Taxes On Sports Betting Winnings Losses

Excise Taxes Excise Tax Trends Tax Foundation

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Tax Issues For Professional Gamblers Journal Of Accountancy

U S Top 5 Earners For Sports Betting Tax Revenue By State In 2020 Gaming And Media

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Play Your Tax Cards Right With Gambling Wins And Losses Cmr Associates Llc