how much tax on death

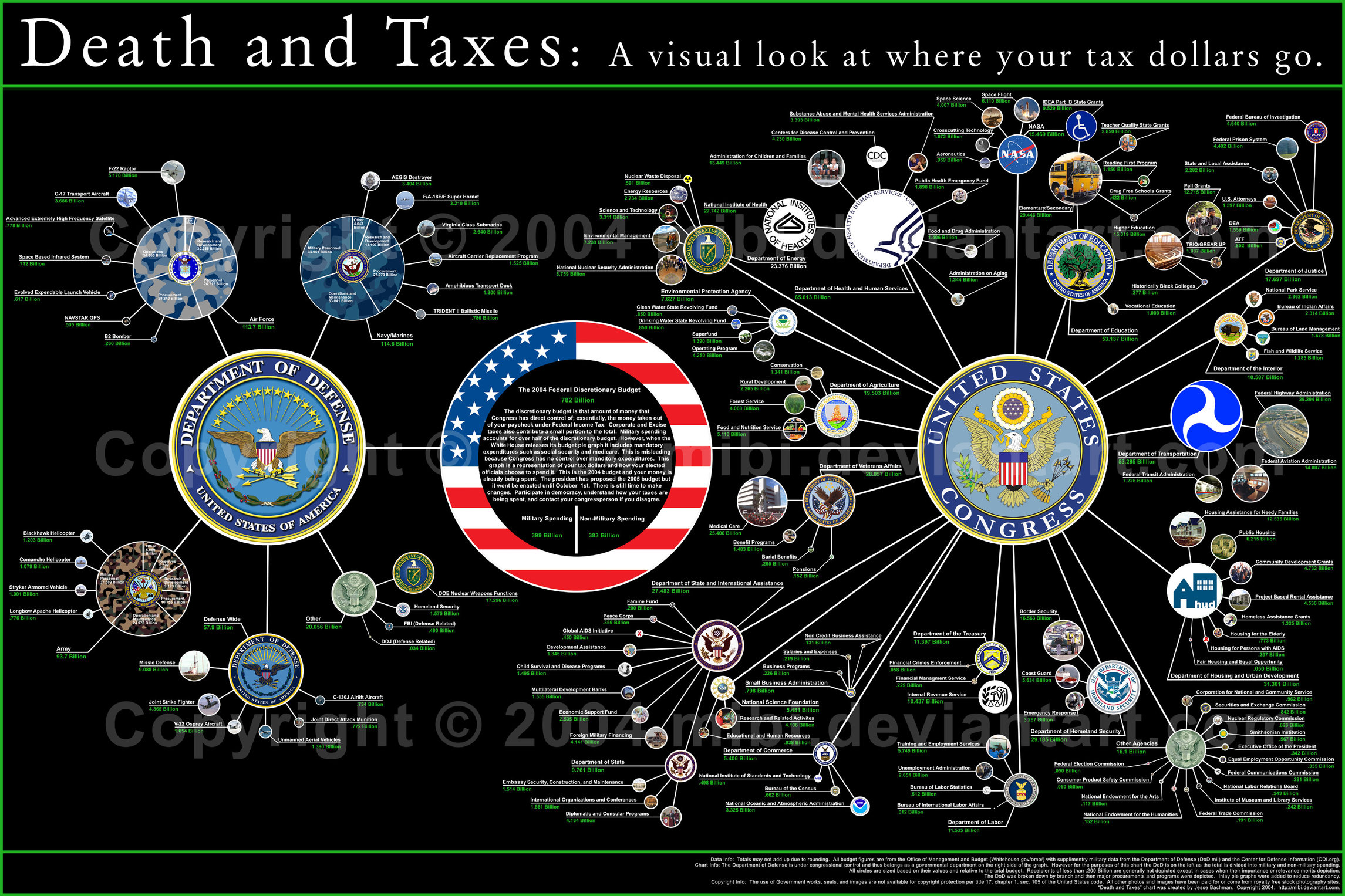

Every taxpayer has a lifetime estate tax exemption. Thats 40 cents of every dollar you transfer.

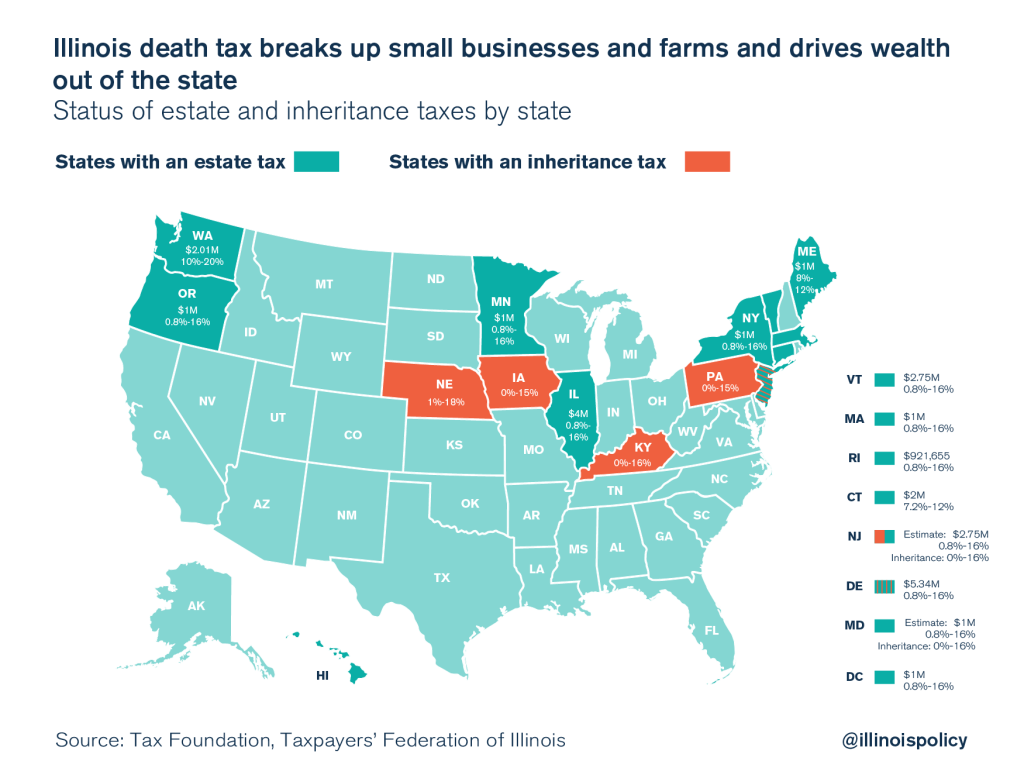

Federal Tax Changes Could Pressure Illinois To Repeal Death Tax

All the assets of a deceased person that are worth 1170 million or more as of 2021 are subject to federal estate taxes.

. The Estate Tax is a tax on your right to transfer property at your death. The federal estate tax sometimes called the death tax is a one-time tax that is imposed at death. Additional RRSP contributions.

EST Troy Davis was put to death by the state of Georgia after the US. The resulting death tax duty 39 x 990000 248300 would amount to 634400. The Estate and Gift Tax rates are found under 26 US.

Advantages of Death Taxes. It is sometimes referred to as a death tax Although states may impose their own estate taxes. The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The higher the value of the estate the higher the tax rate you will pay. Heres a breakdown of each states inheritance tax rate ranges.

That amount increases to 1206 million for the 2022. On the low end of the scale the rates are 18 for taxable amounts less than 10000. Inheritance tax is imposed on the assets inherited from a deceased person.

11 That means if you had the money you could whip out your checkbook and write 16000 tax-free checks to. Californias new death tax is a year old. Currently estates under 114 million are exempt but this reverts back to 5.

The gift tax exclusion for 2022 is 16000 per recipient per year. The American Rescue Plan Act of 2021 significantly reduced the reporting threshold associated with Form 1099-K for card payment processors and third-party payment. Some states and a handful of federal governments around the world levy this tax.

Anniversaries and birthdays are usually thought of as celebratory events but on February 16th California marked an unhappy. On September 21 2011 at exactly 1108 pm. Code Section 2001 also known.

How Much is the Death Tax. Your estate is worth 500000 and your tax-free threshold is 325000. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

The tax rate on. The subject of taxes due at death has gained attention because President Biden proposed in April 2021 eliminating the so-called step-up in basis for gains above 1 million or. The estate can pay Inheritance.

The following are some advantages of death taxes. For amounts over 1 million those. Federal exemption for deaths on or after January 1 2023.

Supreme Court failed to grant him a stay. Under no circumstances can a deceased annuitants legal representative make a final contribution to the deceaseds RRSP after death. After a death some await an inheritance how much must be passed before it is taxed in California New York Texas.

An estate tax is a tax imposed on the total value of a persons estate at the time of their death. The Internal Revenue Service IRS imposes an estate tax on the value of all of an estates assets at the time of death. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15.

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

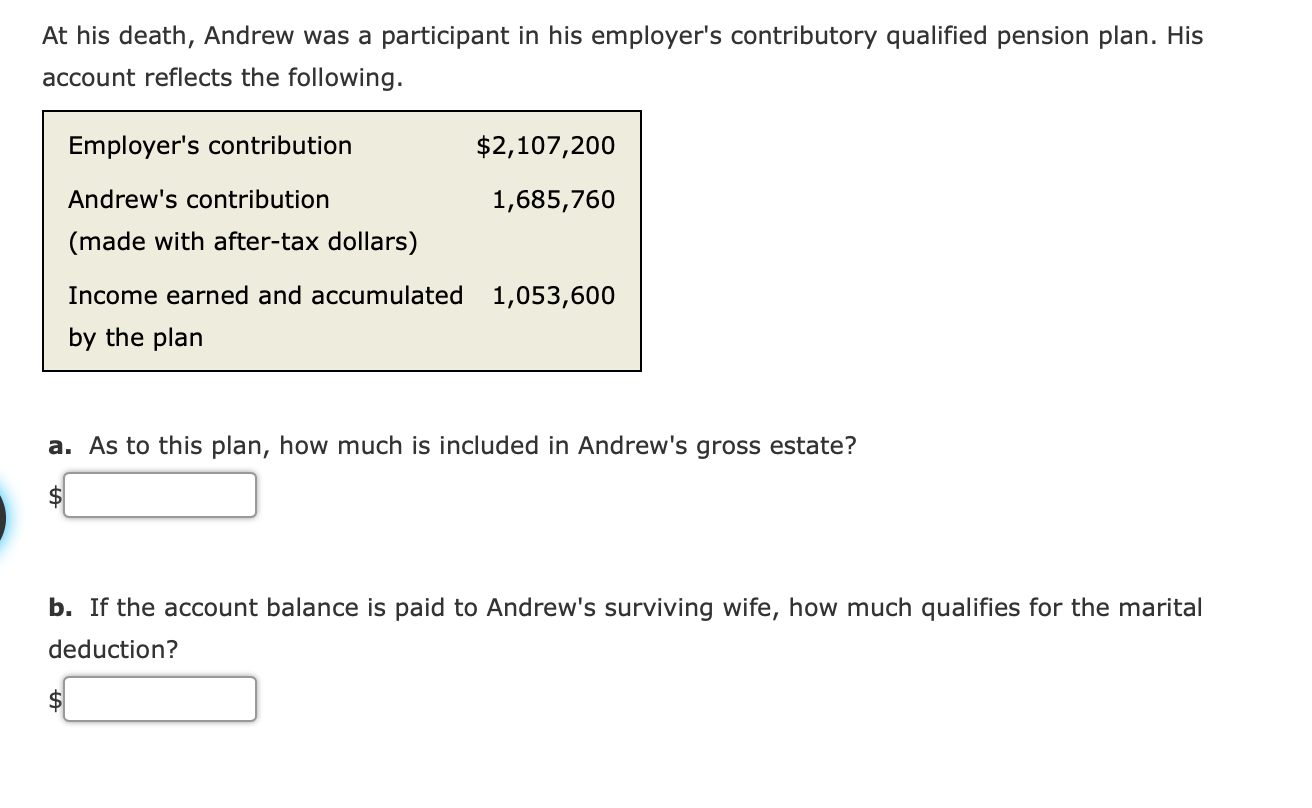

Solved At His Death Andrew Was A Participant In His Chegg Com

To A B Or Not To A B That Is The Question Botti Morison

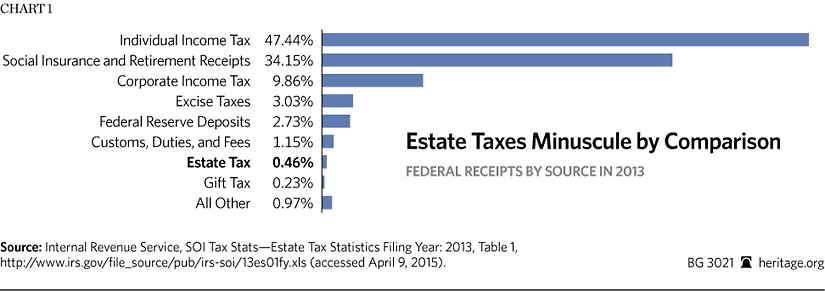

State Death Tax Is A Killer The Heritage Foundation

Solved Problem 16 5 Static Question Help Upon Her Chegg Com

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

The Box Is There For A Reason Of Death And Taxes And Cockroaches The Box Is There For A Reason

Does Your State Have An Estate Or Inheritance Tax

How Does A Death In The Family Affect My Taxes

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

California Estate Tax Everything You Need To Know Smartasset

What Is The Death Tax Credit Karma

Exploring The Estate Tax Part 1 Journal Of Accountancy

Inheritance Tax Here S Who Pays And In Which States Bankrate